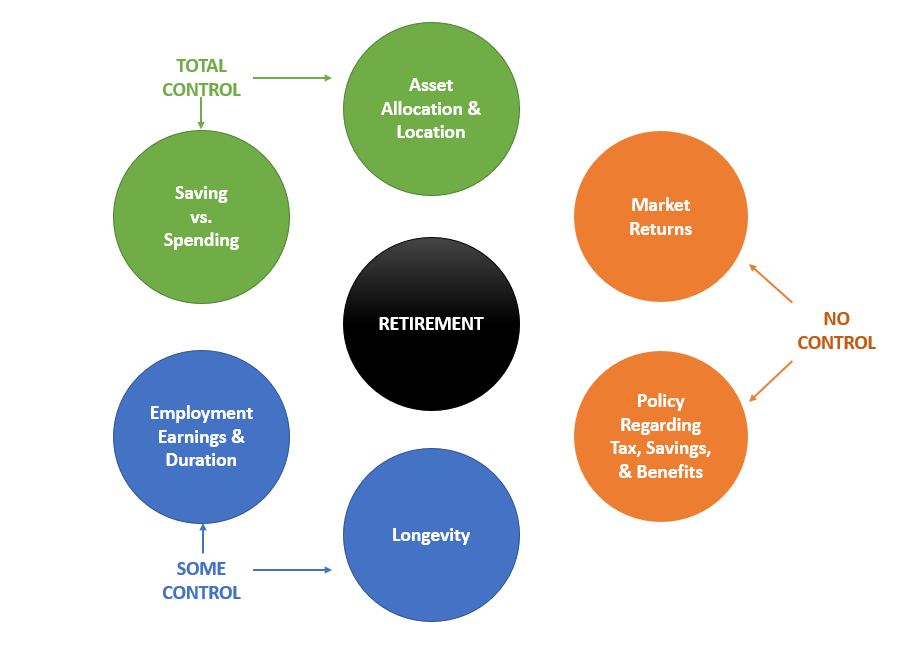

Planning for retirement can seem like a daunting task with so many uncertainties and variables to consider. We believe successful planning is an ongoing process driven by your personal goals and core values. While every client’s situation is unique, the majority have to address several common retirement risks:

- Longevity Risk (Outliving Your Money)

- Inflation Risk (Loss of Purchasing Power)

- Investment Risk (Market Volatility)

- Interest Rate Risk (Reduction of Income)

- Employment Risk (Fewer Job Opportunities)

- Public Policy Risk (Change to Taxes, Benefits)

- Death of a Spouse (Lost Income)

- Unexpected Expenses (Long Term Care, Family Support)

Planning can help address and minimize the financial impact of these risks to you and your family. It helps you visualize your future, giving you greater perspective to enjoy the retirement years instead of dealing with anxiety and fear of the unknown.

By taking the time to create a customized plan, your future goals become more realistic and attainable. During the emotional transition into retirement, it can be comforting to have answers to several key retirement questions:

- How much can we safely withdrawal from our portfolio assets each year?

- What strategies are available to reduce our taxes?

- How will inflation impact our purchasing power over time?

- Should adjustments be made to our investment allocation?

- When is our optimal time for claiming Social Security benefits?

- How does a premature death impact our lifestyle?

- Will our plan be able to sustain a long-term care event?

- Can we afford a second home or other large purchase?

- How will we be affected by increasing healthcare costs?

- Can we afford to leave a legacy to our family or favorite charity?